Interested in seeing a demo?

Fill out the following information (please ensure you provide some detail on the problem you are looking to solve or the Messagepoint product you are interested in).

Like organizations in nearly every industry today, insurers are pushing for digital innovation as a means to improve customer acquisition and the customer experience. This focus is essential for future success, but a danger also lurks in this strategy.

With digital channels clearly proving their worth, marketers are in danger of overly focusing on the new communication channels, under-utilizing traditional means of communicating with customers such as direct mail, which recent research indicates is as effective as ever, if not more so.

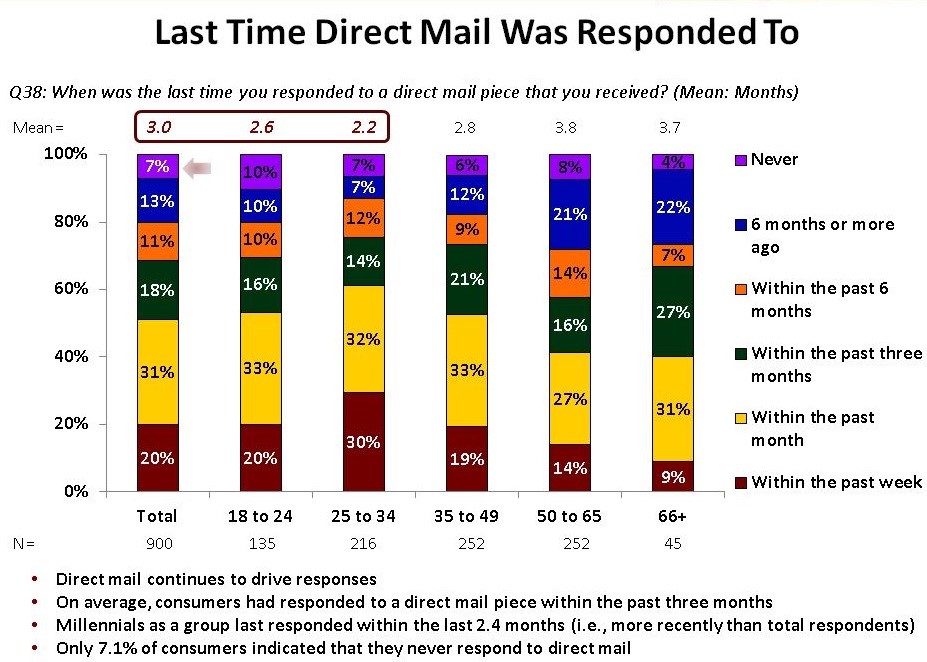

A recent study by InfoTrends, a worldwide market research and strategic consulting firm, and co-sponsored by Prinova, reveals the continuing effectiveness of direct mail. The study, “Direct Marketing Production Printing and Value Added Services,” found that direct mail is being responded to at a high rate across every age group.

Perhaps particularly surprising to many is the strong response rate for those in the millennial generation, since this demographic is by far the most digitally connected we have seen. However, despite their digital connectedness, millennials reported that as a group they:

Perhaps most important, 63 percent of millennials who responded to a direct mail piece within a three month period actually made a purchase.

A USPS study reached a similar conclusion about millennials’ interest in receiving political direct mail. Commenting on the study, USPS sales VP Cliff Rucker said, “As the much-coveted demographic of 18- to 24-year-olds has grown up with and around computers, focusing exclusively on digital channels seems like the obvious strategy. What we actually found was that millennials are far more likely than non-millennials to read and engage with direct mail, particularly political mail.”

Consumers open direct mail for a number of reasons, but interest in the products and services offered tops the list. Additionally, one quarter of those in the 25-34 year old age range opened direct mail because of the print and image quality and 25 percent of millennials consider reading direct mail a leisure activity. Personalization has a very strong influence on whether a recipient will open the direct mail they receive.

Additionally, recipients 65 or younger are more likely to prefer direct mail over email correspondence or consider direct mail and email to be equally preferable. Similarly, those under the age of 65 are more likely to take action in response to direct mail versus email or are equally likely to take action in response to either a direct mail or email communication. The value of a cross-media marketing approach is strongly supported by these results.

The InfoTrends research supports several key points about how direct mail influences consumer purchasing behaviors:

The research found that almost two-thirds of marketers are attempting to coordinate direct mail with other marketing activities, and a top goal is to improve data-driven personalization and relevant communications with direct mail. Nonetheless, a danger remains that insurance organizations may neglect direct mail in favor of the latest new digital channel.

One important fact that the InfoTrends research revealed was that more than 37 percent of the data that marketers require for an effective direct mail campaign is controlled by IT, signaling the need to leverage customer communications management (CCM) technologies that can merge silos of critical data repositories.

Insurance organizations striving to make direct mail as effective as possible should make sure the CCM platform used to create the direct mail provides an intuitive interface for non-technical users to easily visualize and build out content and rules intended for each touchpoint. It should also enable a high degree of variability to provide consumers with information that is highly relevant and personalized to them.

The InfoTrends research demonstrates the need for marketers to integrate direct mail with today’s digital channels. With personalization, color and high quality printing, direct mail can make a powerful impact on all customer groups, even digitally-focused millennials.

BACKGROUND: The Pressure of Annual CMS Updates for a Lean Team ATRIO Health Plans is a Medicare Advantage…

Read the customer story

Enterprise software has aimed to remove friction, reduce reliance on technical resources, and put more control in the…

Read the Article

Increasing Borrower Satisfaction Starts with Modernizing Servicing Communications The results of J.D. Power’s 2025 U.S. Mortgage Servicer Satisfaction…

Read the Article